Scale your advisory business by partnering with our tax team. We handle the behind-the-scenes filings and complex tax strategies, so you can focus on high-value financial planning and client relationships.

Our Services

- Proactive Tax Planning & Advisory: Forward-looking tax strategies designed to minimize liabilities and align with truly comprehensive financial plans.

- Tax Preparation & Compliance: Accurate, timely filings optimized for success.

- Collaborative Client Support: We love working with advisors to ensure we are taking advantage of all we can.

- Expert Tax Services: Expat taxation, small business support, and tax strategies for major life transitions, such as home or rental sales, Roth conversions, and more.

- Timely Communication: We strive to respond to you within 48 hours during tax season.

Why Partner with Us?

“I could tell that Matteo was incredibly knowledgeable and was able to tackle a difficult situation that others I had contacted could not.” -EK in GA

Fee-Only: We do not accept vendor revenue share for referring clients to them (Gusto, Intuit, etc)

Expertise: Federally licensed tax professionals with in-depth knowledge of tax law as it applies to advisor clients.

Collaboration: Seamlessly integrate with your financial planning process to provide holistic client support.

Efficiency: Streamlined systems ensure a smooth experience for you and your clients.

Results: From reducing tax burdens to ensuring compliance, we help your clients achieve greater financial clarity.

Client Experience

2. Client invited to tax portal to upload past 2 years of returns

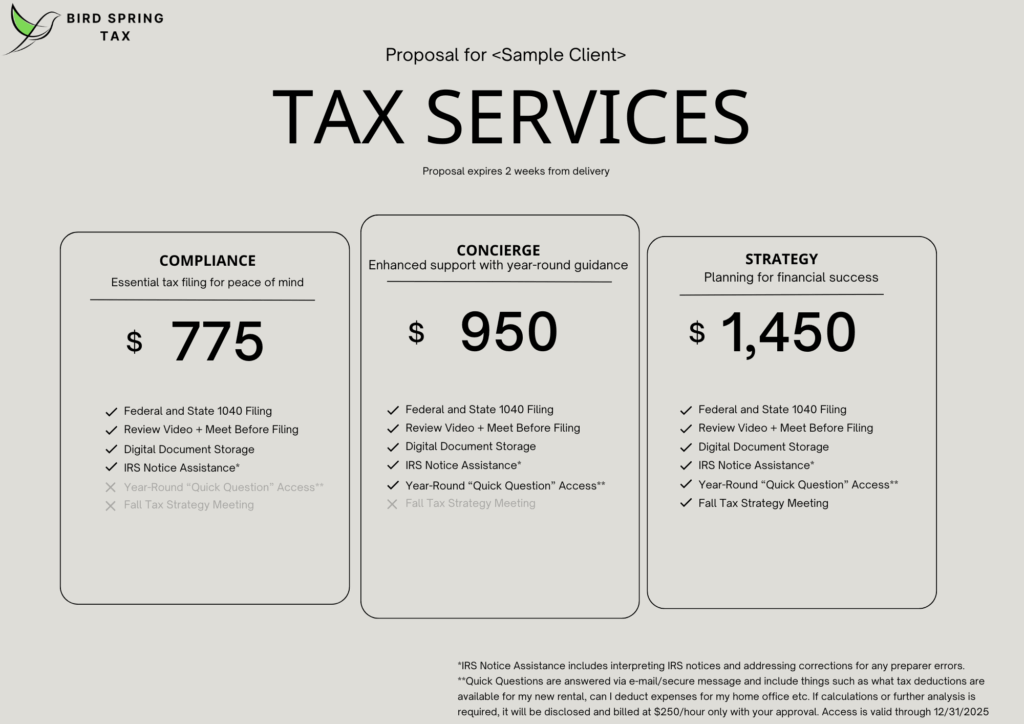

3. We prepare a custom quote with different packaged levels of service

4. We send an explainer video and offer a time to meet with the you and the client before filing to confirm

5. e-Sign, pay remaining balance, and we file!

Case Studies

Hypothetical and/or anonymized from real clients

Carol was a crypto wizard. She knew how the platforms worked, had a sizable portfolio, and was active in crypto governance. But she still needed a financial advisor to help her create her retirement plan. The advisor wasn’t sure how air drops and staking worked and that is where we came in.

We worked with Carol to get CSV exports of her crypto transactions to ensure basis was tracked and the correct tax treatment was used on the airdrops and staking.

Total Fee: $1850. Client opted to only pay for tax preparation with W2 income, numerous crypto transactions, and brokerage account with no state income tax.

Sally was in year 3 of her consulting business and kept hearing about S Corps so she asked her financial advisor Doug. Doug thought they were a great idea but wasn’t sure how exactly the taxes would change. Rather than run the calculations themselves, they referred the client to us to assist with the analysis.

We performed reasonable compensation analysis and built tax projections for Schedule C taxation versus S-Corp. The analysis revealed she was in the sweet spot where it would make sense for her business after analyzing QBI phaseouts, FICA, additional tax compliance fees, and her local tax rules. We set her up with payroll and bookkeeping solutions as well as a tax compliance package to ensure the proper returns with the IRS and her state are filed and will continue to be filed. We also worked with her advisor to recommend a Solo 401(k) to take advantage of automated contribution credits without needing the client to actually make the contribution.

Total Fee: $1,495 for S-Corp analysis and retirement plan set up. Client selected $295/month package including bookkeeping, tax filing (1120-S, 1040), assistance with IRS Notices, and unlimited “quick questions” support.

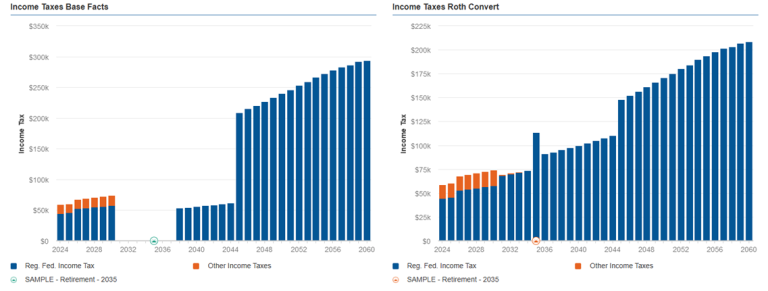

Roger, a 55-year-old engineering manager at Apple, just stepped away from their work to decompress and potentially retire. Chris, their advisor, knew this was a great opportunity for a Roth conversion so he reached out to us for the analysis. We ran detailed tax scenarios using their eMoney Cash Flow Reports showing their advisor the benefits of consulting part-time and helped them decide on an ideal amount to Roth convert to avoid costly RMD’s while being mindful of expensive IRMAA penalties.

After collaborating with their advisor, we ran a joint meeting with the client and their advisor to go over the implications and make smart decisions about their retirement plan.

Total Fee: $1,250

Pieter de Hooch was a renowned painter but he was uneasy having so much money in the stock market. He wanted something real, a real asset.

de Hooch identified a property he wanted to buy for “house hacking”, a term he learned about on a podcast, and asked his advisor what she thought. The advisor was cautiously optimistic but wasn’t sure of the actual take home income and taxes.

We were hired to figure that out, so we analyzed de Hooch’s tax return and worked through an after-tax projection. Then we presented this to the advisor while explaining passive activity losses and how depreciation can boost their real return.

Ultimately the client and their advisor decided to not move forward with the investment at that time due to passive loss limitations but found the analysis invaluable in case a better opportunity presented itself in the future.

Total Fee: $850

Let’s Elevate Your Practice Together

Ready to enhance your client offerings with professional tax services?